Our solutions in tax, compliance, and business consulting to help you achieve financial clarity, streamline operations

Reliability is an investment, not a cost. TCO connects the technical outputs of our RAM analysis directly to your financial bottom line, calculating the Net Present Value (NPV) and tax implications of every design decision.

Most financial models are built on guesses. Ours are built on engineering simulations. TCO bridges the gap between technical reliability and financial decision-making.

TCO creates a direct bridge between technical performance and financial outcomes

Technical Output

Direct Data Feed

Financial Output

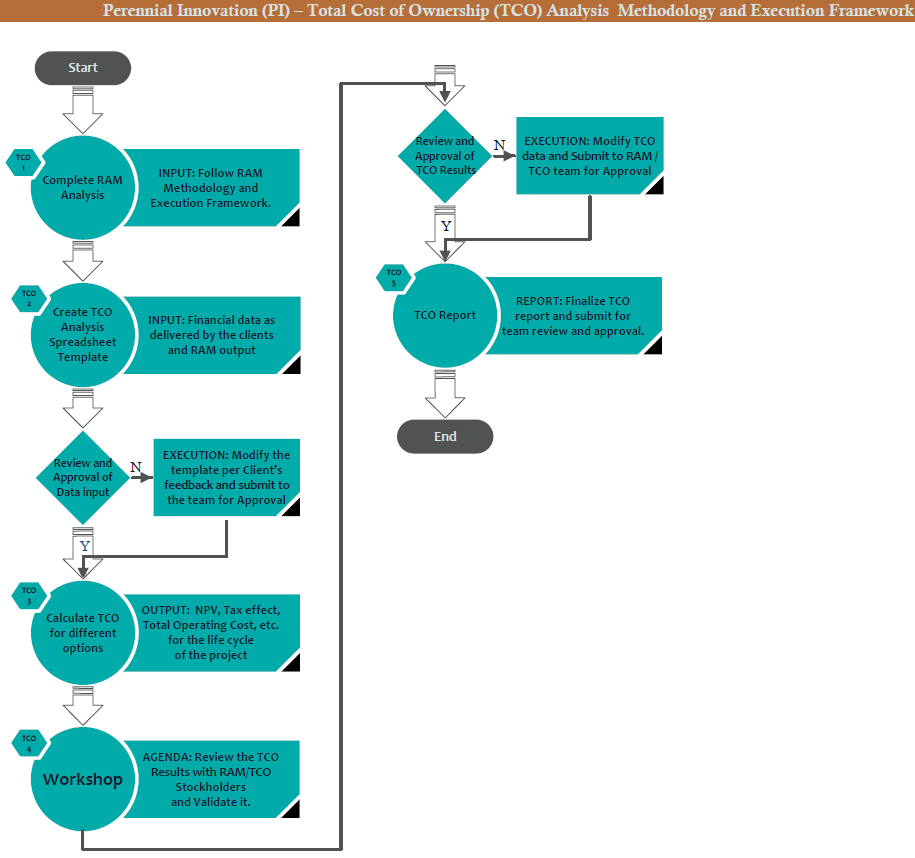

A streamlined, iterative process that transforms engineering reliability data into CFO-ready financial intelligence

Financial models built on engineering data, not guesses

We take validated RAM outputs:

Every dollar in our TCO model is tied to real engineering data:

Custom financial model tailored to your organization

Custom TCO Analysis Spreadsheet combining RAM outputs + your financial data

We calculate TCO for multiple design alternatives:

Collaborative evaluation cycles until stakeholder sign-off

This is where the TCO methodology differs from traditional financial analysis. We don't deliver a spreadsheet and walk away—we refine it with you.

Share TCO analysis with stakeholders

CFO, Finance, Engineering review assumptions

Adjust model based on client feedback

Cycle repeats until stakeholder sign-off

CFO-ready documentation:

Traditional TCO models use generic assumptions. TCO uses engineering-validated reliability data to drive every financial calculation.

Direct data flow from RAM simulation to financial model—no manual assumptions or guesswork.

Complete lifecycle cost evaluation including depreciation, tax effects, and discount rate application.

Workshop-driven approach ensures finance, engineering, and operations teams are aligned on assumptions.

Justify reliability investments by quantifying the financial impact of redundancy, equipment quality, and maintenance strategy choices.

Provide CFOs and investment committees with bankable financial analysis tied to engineering validation, not generic assumptions.

Compare competing vendor proposals on a lifecycle cost basis, revealing hidden OPEX costs behind low CAPEX bids.

Evaluate the ROI of reliability upgrades, maintenance strategy changes, or equipment replacements in existing facilities.